For parents with children, there are a lot of changes to come to child benefits. In the last federal election the Liberal’s promised to expand tax free child benefits.

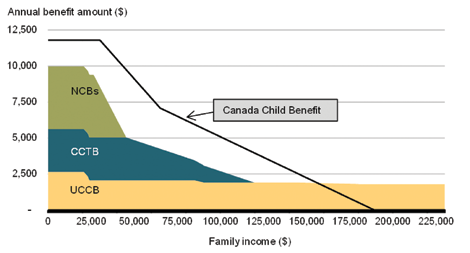

Starting in July 2016 existing child benefit programs will be replaced with a tax-free benefit called the Canada Child Benefit (CCB). The amount you get depends upon your family income and the benefit is not taxable. The chart below compares the old and new programs.

The less you earn the more you get. Some families will see an increase in what they are getting and some will see the benefit decrease.

HOW MUCH WOULD WE GET? HOW CAN WE MAXIMIZE THE BENEFIT?

A family with a family net income of $80,000, one child under six, and one child over six, would get about $6,220 per year2 ($518 per month) from the CCB program.

If the same family’s net income was over $190,000 per year they would not receive anything.

If you are curious about how much you might receive in July, there is an online calculator that you can use to estimate the benefit.

Deductions that you made in your 2015 tax return will influence how much of the CCB benefit you get in July. For example, Child Care Expenses, RRSP Contributions, Union and Professional Dues (to name a few) all increase the benefit that you would receive.

THE O’CONNOR FAMILY

Let’s look at an example to illustrate the impact of deductions. The O’Connor’s live in Toronto, have one income of $80,000 per year, a new born child and six-year old child.

Let’s say the O’Connor’s decided to direct their CCB benefit of $518 a month to an RRSP. This reduces their taxable income and results in a tax refund of $2,0523. It would also increase the CCB benefit by $355 next year. They then decide to put the tax refund of $2,052 into an RESP for the kids to get 20% government grant of $410.

Repeating this process results on huge savings over time for the O’Connor’s. Their RRSP would grow to about $140,000 by the time their youngest child leaves high-school. The RESP would grow to $40,000 by the time the oldest child leaves high-school. These figures assume an investment rate of return of 5.0%4.

It really does pay to take advantage of the benefits by starting early. This example is an illustration that might not apply to your situation. Be sure to talk to a Certified Financial Planner to see how you can make the most of the benefits.

IT’S NOT TOO LATE TO GET UCCB, IF YOU MISSED IT

The Universal Child Care Benefit (UCCB) was extended to children over the age of six in 2014. I have seen that some qualifying families have not received the benefit.

If you have a child under the age of 18 and you did not receive the UCCB benefit in 2015, it’s not too late to apply and get some retroactive payments. You can complete an application and you may receive some retroactive UCCB benefits. Be sure to complete it as soon as possible to get the maximum benefit before it is gone.

About Colin Barry – Canfin Financial Group

Colin Barry is a Certified Financial Planner (CFP) who works with families and small businesses to plan their finances and make the most of what they have. Visit www. colinbarry.ca for more information. Fee for service financial planning and investments provided through Canfin Magellan Investments Inc. Insurance provided through Canfin Capital Group Inc.

Make the Most of Child Benefits. They have changed. Again.