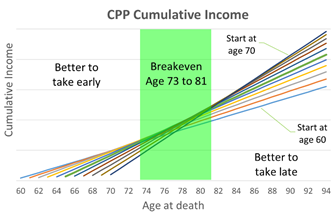

There can be benefits of hedging your bets and taking CPP early and saving it in a TFSA or RRSP (if you have the room). You would need invest to expect high rates of return for this to work. The rate of return would need to make up for the lower CPP levels. It can be a good approach for one spouse to do that while the other defers CPP.

When should I make the decision?

I find the best approach is to make the CPP decision each year starting at age 60. By doing this you have the best information available to you. You can reliability estimate tax rates and health levels. If you are in a high tax bracket and in good health it may make sense to defer CPP a while. Since you can opt into CPP at any time between age 60 and 70 you can even make the decision every month.

For a couple approaching age 60 it is a $400,000 decision that you get to make once. It certainly pays to get an analysis done for you by a Certified Financial Planner. That way you can be confident that you are making the most appropriate decision for your circumstances.

About Colin Barry – Canfin Financial Group

Colin Barry is a Certified Financial Planner who works with families and small businesses to plan their finances and make the most of what they have. Visit www.colinbarry.ca for more information. Fee for service financial planning and investments provided through Canfin Magellan Investments Inc. Insurance provided through Canfin Capital Inc.

[1] https://www.canada.ca/en/services/benefits/public pensions/cpp/cpp-benefit/amount.html [1] http://fpsc.ca/docs/default-source/FPSC/news-publications/2018-projection-assumption-guidelines.pdf